Patient Insurance

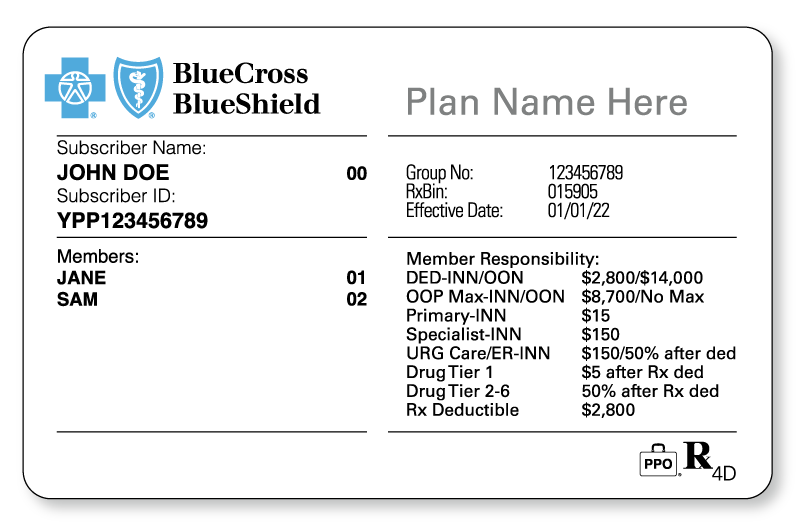

We believe verifying patients’ insurance is vital to the success of your behavioral health practice. Prior to the first visit, you should know the patient’s responsibility at the time of service. When verified, the patient’s verification will confirm the patient has active coverage, a co-payment, or a deductible.

With Billing Service Stand-Alone Service

Why is it important to verify a patient’s insurance?

It is paramount to authenticate that the patient’s insurance is “Active.” Along with patient (full name, date of birth, address and sex) demographic information. This information will reduce billing errors and allow for higher pass through rates for submitted claims to insurers.

Why is it important for me the provider?

It’s critical to the revenue flow of the provider to collect the accurate out-of-pocket amount from each patient, whether they have a co-payment or a deductible. In the case a patient has a deductible, there will be no reimbursement from insurance.

Co-payments

It’s common for a patient to have a $25 or $35 co-payment. Insurance will send the reimbursement to the provider for the remainder of the “allowed” rate for the service code(s) for the session. Benefits are determined whether the provider is credentialed or non-paneled by the individual insurance company.

Deductible

Your patient may have a $3,000 deductible. This is important to know, as there will be no reimbursement from insurance until the deductible is obtained. All monies for the service are paid by the patient out-of-pocket.

We will also obtain from insurance the accumulations towards the deductible, which matters to see how far the patient may have before insurance is to start paying for services, versus the patient.

Generally, after the deductible is met, the patient will need to pay the coinsurance for their out-of-pocket expense. Many patients will have a coinsurance of 20% or 30% of the “allowed” rate. Benefits are determined whether the provider is paneled or non-paneled by the individual insurance company.

Insurance will reimburse the provider the remaining amount by check or EFT.

Where do you submit mental health claims?

Generally, mental health claims are serviced by the healthcare insurance company on the insurance card. Often, mental health claims are submitted to a third-party insurer. It is our responsibility to locate the insurance company and obtain the required information to submit a claim(s) successfully.

With a third-party insurer, we will obtain the assigned member ID, along with Payer ID, to submit claims for processing. Along with verifying if the provider is in-network or out-of-network with the third-party insurance. Along with the corresponding benefits.

Whether you are using EHR software (Simple Practice or Therapy Notes) or forwarding an Activity Log all claims are submitted through a clearinghouse. The clearinghouse disperses all claims to the corresponding insurance payer by the Payer ID on the CMS-1500 claim form.

We Verify Patient Benefits For Providers As A Stand-Alone Service

As a mental health billing service, we have options to best suite your practice needs. Review the tiers for the offering that is best for your practice

Patient Verifications

Tiers per Month for Standalone Service

SILVER

| 1 TO 7 |

Patient Verifications in a calendar month

GOLD

| 1 to 15 |

Patient Verifications in a calendar month

PLATINUM

| 1 to 25 |

Patient Verifications in a calendar month

INSURANCE TERMINOLOGY

CO-PAYMENT

A fixed amount that a patient pays out of pocket. For example, the patient pays $40.

DEDUCTIBLE

The Deductible is the amount of money that the patient will pay out of pocket. After the deductible is obtained, then insurance will begin to pay. For example, the patient has a deductible of $2,000. The patient is to pay the Provider the “Allowed” amount until the deductible is reached.

“ALLOWED” Rate

The maximum amount insurance will pay for a covered service code. If you are credentialed with the insurance company, this is the rate you agree to charge each patient. For example, the 90834 “Allowed” rate is $100.